It's Happening Again: Promise Of Rate Relief To Spark Spring Housing Market

.jpeg)

.jpeg)

Canadians could see a lower interest rate as soon as spring according to some experts, though the Bank of Canada’s (BoC) Tiff Macklem has been careful not to say anything concrete about cuts and their timing.

TD Economist Rishi Sondhi says that while there is still plenty of uncertainty around when the first cut will happen, TD’s position is that it could be in April or June, with a lean towards April.

“Now before that, the bank is going to have to signal that they’re going to be taking the policy rate lower, so that'll probably have some beneficial impact for [housing] market psychology... and highly stimulative for demand,” Sondhi tells STOREYS.

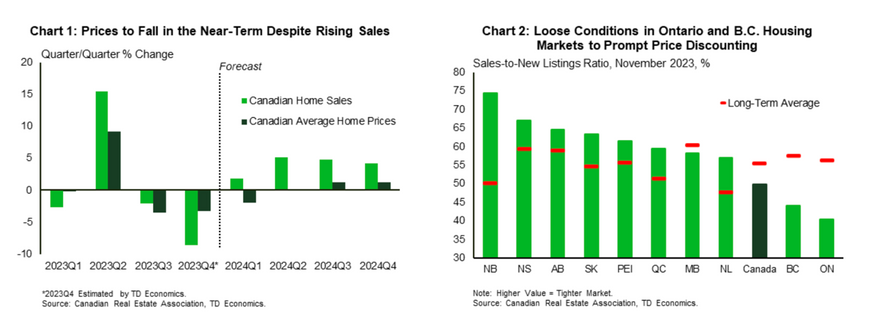

“We're forecasting sales to increase every quarter this year [with] a particularly large increase in the second quarter of this year, which, of course, overlaps with the spring selling season period. And that’s across Canada; we're expecting pretty strong sales growth.”

Sondhi is not alone in predicting that an uptick in Canadian home sales is imminent. Royal LePage President and CEO Phil Soper said in a report published Monday that he expects the market to rally in the first quarter of the year — before the first interest rate cut comes to a head.

But while Royal LePage is calling for quarterly price gains through the first half of the year, TD’s expectation is that prices will fall in the near term, before flattening in the second quarter of the year.

“And that's because markets are quite loose in Ontario and BC from a supply-demand perspective,” Sondhi explains.

“Supply, I would say, is at normal levels in those markets — or, perhaps a touch below — but demand is quite depressed. And typically, when you have that sort of imbalance, you tend to see some price discounting. So we think there will be some price discounting that takes place in Ontario and BC over the next few months, and that will weigh on the overall Canadian price story.”

Nonetheless, if what happened last spring is any indication, the mere whiff of rate relief should help to boost home sales across Canada in the near term. However, Sondhi warns that there is another outcome worth considering if the housing market were to heat up prematurely, or in a way that prompts a “broader impact” on inflation.

“The bank could cut the policy rate in June rather than April simply to avoid sparking the housing market during the spring selling season,” he says.

“Shelter inflation feeds into their core inflation measures, so to the extent that the market stokes those measures, and to the extent that the bank doesn't want to look past shelter price inflation, that could be a factor in staying the bank's hand if we do see a surge in housing market activity.”

Storeys (Zakiya Kassam, January 17,2023)

Ttodd Savoye and Coldwell Banker are leaders in the real estate community with a reputation for integrity, dedication and as equally important, we are known for achieving results. Our professional, motivated and trustworthy Team Members are committed to delivering quality service for both buyers and sellers. From the very start of your search to the day of your sale, whether it is a condo, townhouse, cottage, farm, or commercial property that you are looking to buy or sell, we are here to help you with real estate choices.

Coldwell Banker - The Real Estate Centre, Brokerage

390 Davis Drive, Unit 101

Newmarket, Ontario L3Y 7T8

Independently Owned & Operated

Get this week's local market conditions by entering your information below.

The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA.The information contained on this site is based in whole or in part on information that is provided by members of The Canadian Real Estate Association, who are responsible for its accuracy. CREA reproduces and distributes this information as a service for its members and assumes no responsibility for its accuracy.

MLS®, Multiple Listing Service®, REALTOR®, REALTORS®, and the associated logos are trademarks of The Canadian Real Estate Association.

This website uses cookies. To learn more, see our privacy policy and you agree to our terms of use.