Income Needed to Afford A Home in GTA

Trying to buy a home in one of Canada's most expensive cities continues to be a struggle for many, as the cost of living continues to soar and wages struggle to catch up.

Even though home prices are on a downward trend across the GTA, the average home in the region will still cost you a mind-boggling $1.1 million, making dreams of owning a property one day difficult to achieve by the average worker.

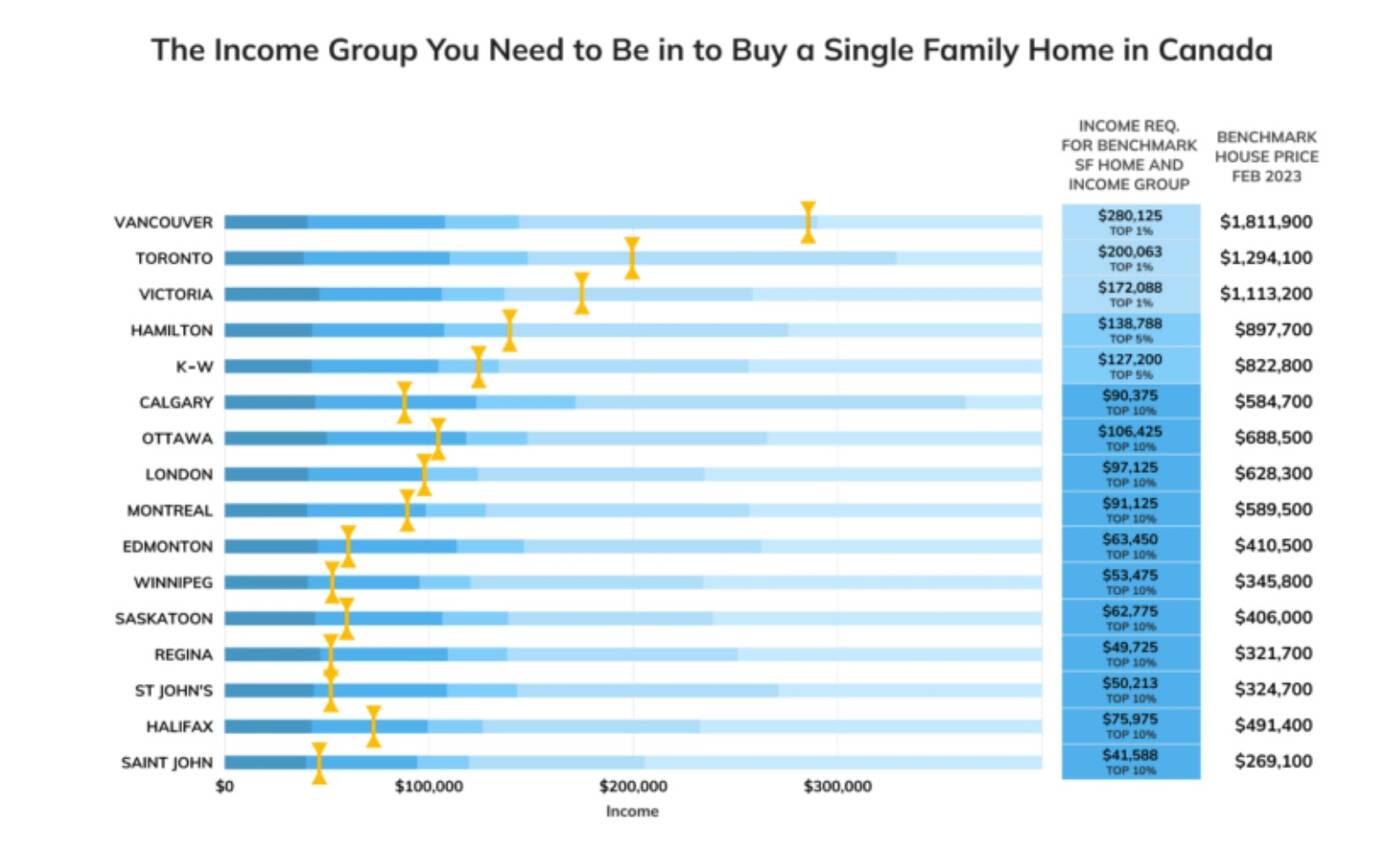

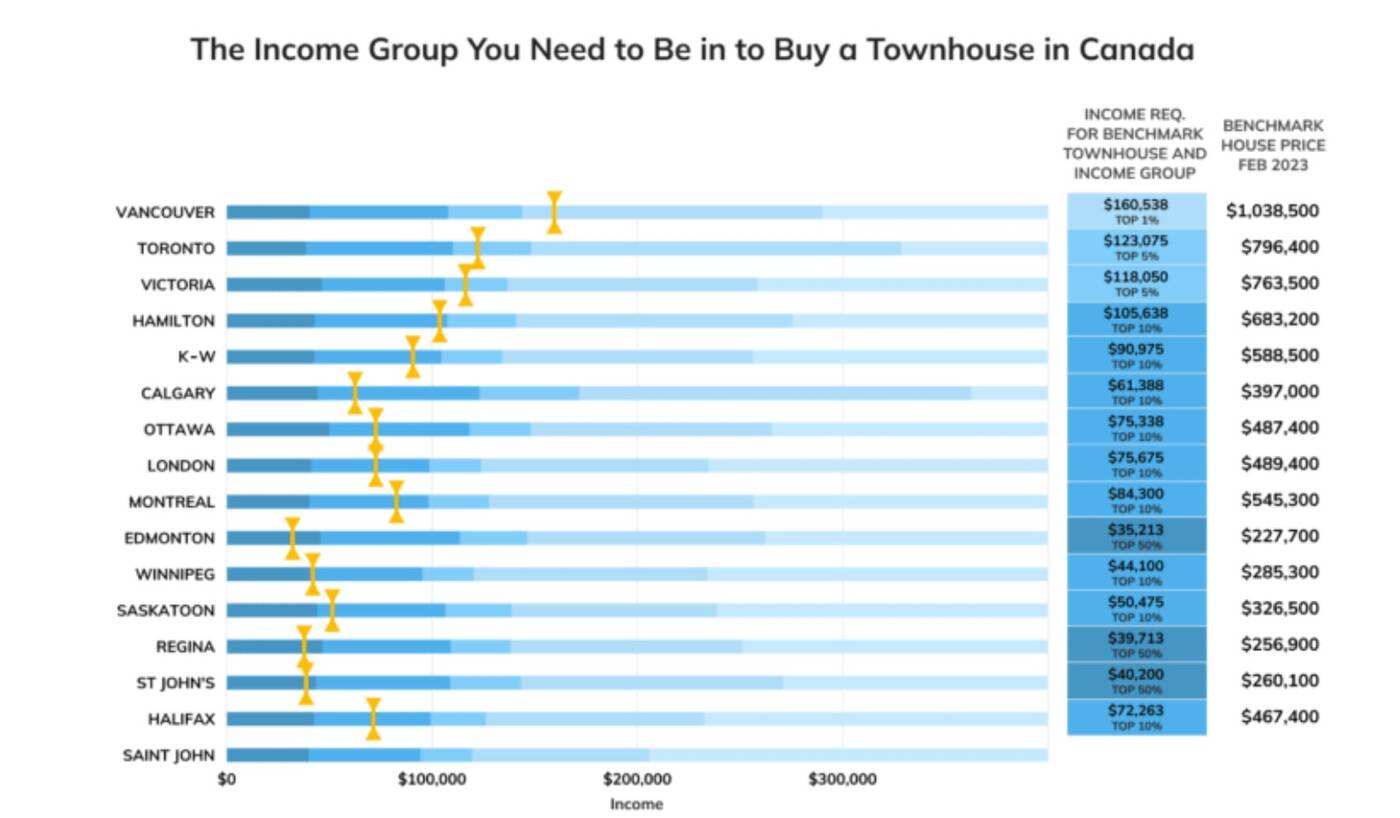

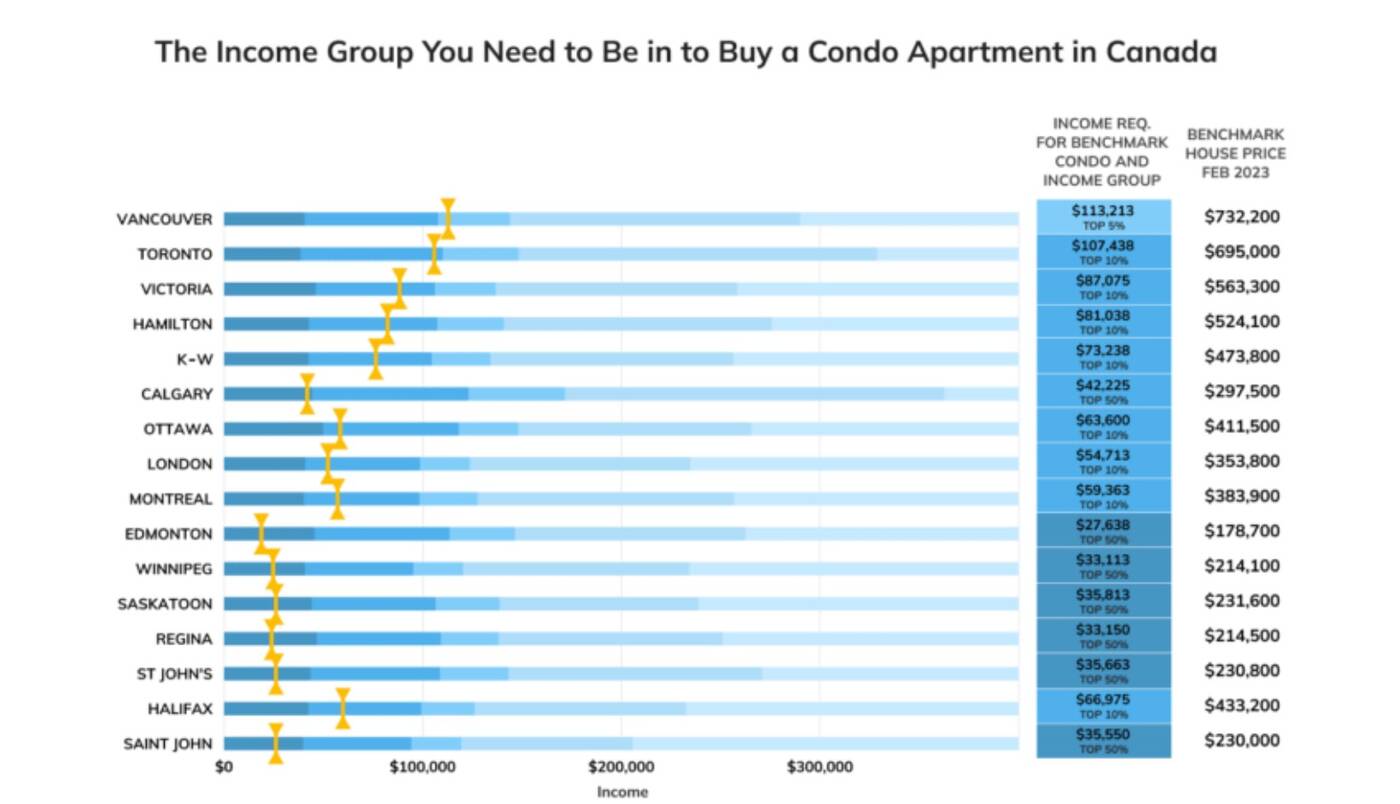

A recent study by Zoocasa analyzed 16 different census municipalities in Canada, including Toronto, and compared the prices for a single family, townhouse, and condo apartment to different income groups, from the top 50 per cent of earners all the way to the top 0.1 per cent.

The study found that prospective buyers have to be in the top one per cent of earners to afford a single-family home in Toronto.

Affordability in each municipality was gauged by how much income was required to afford a home at a benchmark price.

House prices were sourced from the Canadian Real Estate Association, and the minimum income required was calculated using the Ratehub calculator, assuming a 20 per cent down payment, 30-year amortization, and a 4.69 per cent interest rate.

The study identified the benchmark house price for a single-family home in Toronto in February 2023 as $1,294,100.

This means prospective buyers would have to be in the one per cent of earners, or earn an income of $200,063, to afford this type of property.

To afford a townhouse in Toronto at the benchmark price of $796,000, the study found that buyers would have to be in the top five per cent of earners, or earn an income of $123,075.

The benchmark price for a condo apartment in Toronto was by far the cheapest at $695,000 in February 2023.

However, this means prospective buyers will still need to be in the top 10 per cent of earners or receive an income of $107,438 to afford this type of property.

The only other Canadian city that topped Toronto in each category was Vancouver, where the benchmark price for a single-family home in February 2023 was a whopping $1,811,900, setting the income requirement for this type of property at $280,125.

Kimia Afshar Mehrabi (BlogTO, April 5,2023)