Here Is How Much an Average Toronto Home Will Cost By the End of 2024

After a dismal year of sales, realtors at at least one major brokerage are still maintaining faith that Toronto's housing market (and its prices) will pick back up and return to its more lucrative former glory in 2024.

While some real estate experts have predicted further uncertainty, price declines and even a potential crash, Royal LePage is among those calling for prices to keep on rising in Toronto and across Canada this year.

And while most stakeholders say that the future of home sales nationwide will be contingent upon what happens with mortgage lending rates in the coming months, the firm is confident demand will be high regardless.

"I believe the narrative suggesting that the housing market will rebound only when the Bank of Canada lowers rates misses the mark. The recovery will begin when consumers have confidence the home they buy today will not be worth less tomorrow," Royal LePage's CEO says in a new forecast released Monday.

"We see that tipping point occurring in the first quarter, before the highly anticipated easing of the Bank of Canada’s key lending rate."

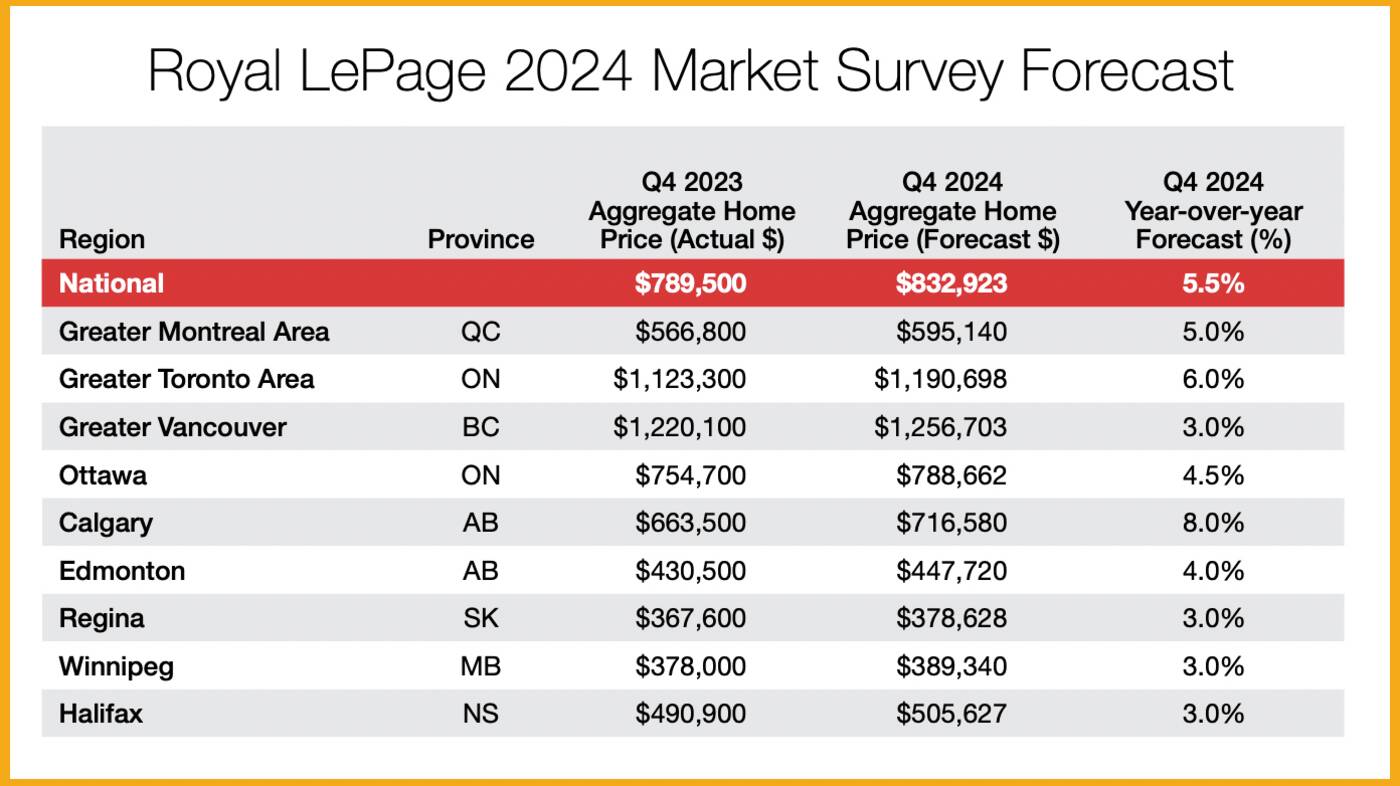

Based on the fact that Canada's national aggregate home price was up by 4.3 per cent in the last quarter of 2023 compared to the same time the previous year, and Toronto's specifically spiked 5.1 per cent over the same time period — the most of any major city in the country — the company predicts more prices increases as we move through this year.

"Canadian consumers are moving through a period of transition and as a result, so are the dynamics of our national housing marke... Early market recovery will be sparked by signs of home price stability, and we are very close to that now," the report reads, adding that home prices are still lower than the peak we saw in 2022, but are above pre-pandemic levels.

As 2024 progresses, the average home in the GTA will rise in price to hit $1,190,698 by year's end, per Royal LePage's estimate — a surge of six per cent from the end of 2023, driven by "a brisk spring" and ever-growing demand.

The only Canadian city due to climb more in price is Calgary, which the brokerage says will see a price jump of eight per cent (reaching only $716,580).

And as usual, Toronto will be beat out by only Vancouver for the title of the most exorbitant place to purchase a home in the country. The west coast city is anticipated to see an aggregate price of $1,256,703 by the final quarter of this year, marking only a three per cent increase year-over-year.

"For the first time in months, Canadians seem to be feeling somewhat optimistic about the trajectory of borrowing costs," Royal LePage's experts write.

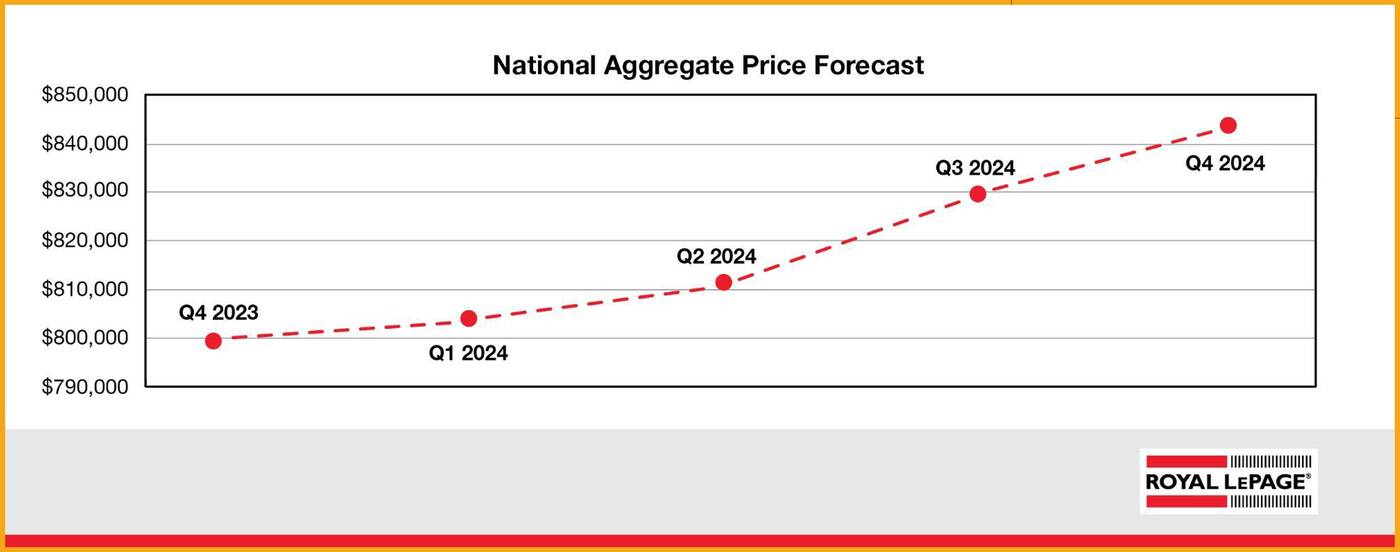

"The first sign of rate cuts could create a flurry of activity in the real estate market, releasing pent-up demand... home prices are forecast to see modest quarterly gains in the first six months of 2024, with more considerable increases expected in the second half of the year due to a boost in activity following a widely anticipated series of cuts."

BlogTO(Becky Robertson, January 16,2024)