Economist Says Canadian Housing In For A Slow Spring

A new report looks ahead at Canadian housing in 2024, and forecasts softer sales and prices across all major markets, as well as a drop-off in homebuilding activity.

Though it seems more than likely that the Bank of Canada (BoC) is done hiking rates for this cycle, the housing market is expected to remain soft through the spring.

Desjardins’ latest housing outlook, published on Monday, forecasts that most major markets will deviate from historical trends come spring, with softer sales and prices anticipated.

“The second round of [BoC] rate hikes may have ended well before November 2023, but its effects certainly haven’t,” writes Desjardins Economist, Marc Desormeaux.

“Initially, sales activity in the high-priced Toronto and Vancouver markets bore the brunt of higher borrowing costs. Yet, at the time of writing, weakness is spreading more broadly, and national-level home purchases have given back three-quarters of the torrid gains experienced between January and June of this year.”

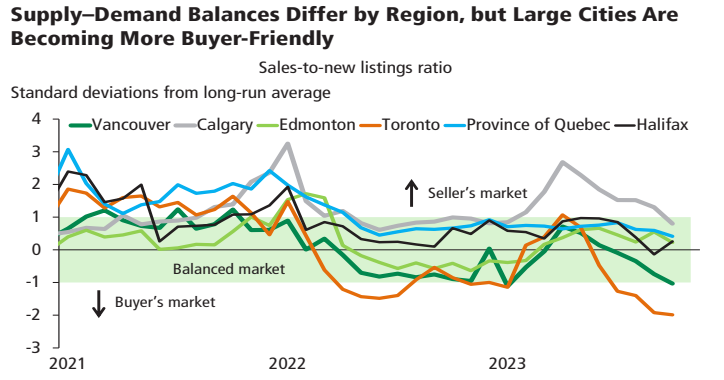

Desormeaux adds that listings are climbing “nearly across the board,” which is a sign that Canadian homeowners are grappling with higher mortgage rates.

Canadian Real Estate Association and Desjardins Economic Studies

“So while supply–demand balances are still tighter in Alberta than in Ontario and BC, all major markets are loosening,” he says.

“There’s a chance that yields begin to move lower early if the Bank begins to signal that rate reductions are imminent. But in general, we think prospective buyers and those renewing may have to wait until cuts begin towards the middle of next year for more relief.”

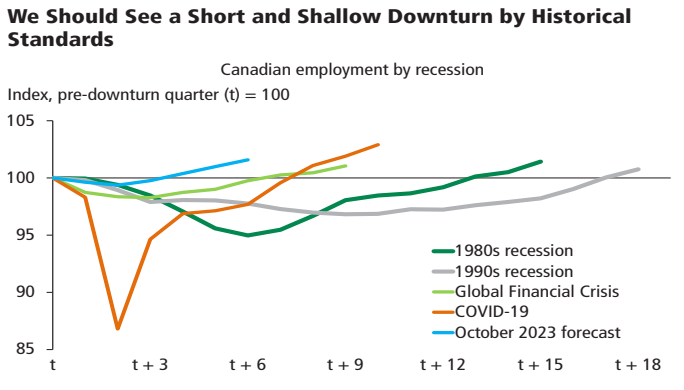

Desormeaux also warns of a “mild recession” (by historical standards) in 2024, which would put additional “downward pressure” on home sales and prices. Interest-rate-sensitive economies like those in Ontario and BC are anticipated to feel recessionary effects “most deeply.”

Statistics Canada and Desjardins Economic Studies

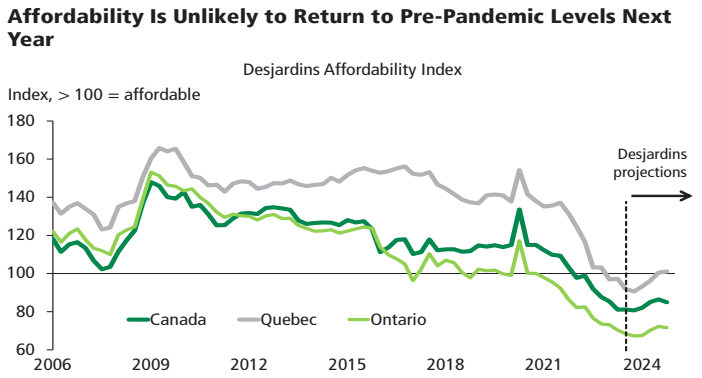

While housing affordability is expected to improve slightly in 2024, “prices should still stay high relative to the last two decades amid elevated interest rates […] leaving most major housing markets in Canada less affordable than before the COVID‑19 pandemic began,” Desormeaux cautions.

Statistics Canada, Institut de la Statistique du Québec, Ontario Ministry of Finance, Canadian Real Estate Association and Desjardins Economic Studies

On the homebuilding front, Desormeaux says that it’s “only a matter of time” before Canadian housing construction slows to a crawl, in contrast to its recent resilience.

“Other than the booming population growth currently underway across much of the country, there aren’t many indicators that suggest conditions supportive of homebuilding,” he writes.

“Interest rates and building material costs are at decades-high levels. Sentiment in the homebuilding sector is very weak. Labour shortages remain in the construction industry, and the average age of construction workers just keeps climbing. With these trends likely to persist to at least some degree over the next few years and economic activity set to fall back as we approach 2024, we see housing starts declining next year.”

Storeys (Zakiya Kassam, November 28,2023)