“Demand Has Been Buildingâ€: Ontario Recreational Property Prices To Lift 8% This Year

Although cottage, cabin, and chalet prices are set to appreciate the most dramatically in Ontario, Royal LePage is calling for price growth across all provincial recreational markets in 2024.

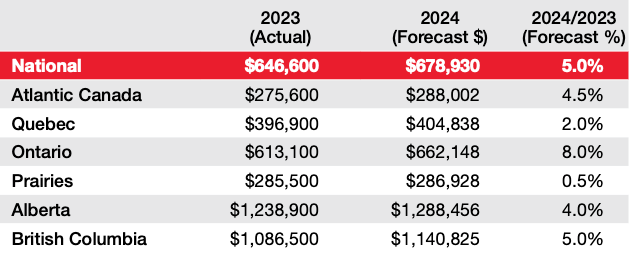

It’s shaping up to be a strong year for Canada’s recreational property segment, according to just-released forecasting from Royal LePage. The Canadian real estate company said on Wednesday that the median price of a single-family home in Canada’s recreational regions is poised to end the year at $678,930, marking a 5% increase over 2023’s level.

Even more notably, annual price appreciation for those same properties is set to clock in at 8% in Ontario, putting the median price at $662,148 for the year. Although prices are forecasted to rise the most dramatically in Ontario, Royal LePage is calling for price growth across all provincial recreational markets this year, with median prices anticipated to rise 5% in British Columbia, 4.5% in Atlantic Canada, 4% in Alberta, 2% in Quebec, and 0.5% in the Prairies provinces.

Royal LePage

Of course, we’re coming off of a quiet few years for Canada’s recreational market. Royal LePage reveals that the weighted median price of a single-family home across recreational property regions slipped by 11.7% in 2022, and then by an additional 1% in 2023. Despite those decreases, the national median remains 59% above 2019 levels.

“Demand has been building quietly on the sidelines,” explains Royal LePage President and CEO, Phil Soper. “Our regional experts tell us that buyer interest is steadily ramping up as the spring market approaches. With hybrid office and work-from-home business models being the norm now, many working people see the opportunity to make much better use of country properties.”

Soper points out that low inventory — a product of pandemic times, when recreational properties were being snapped up at a feverish pace — will play a major role in the anticipated uptick in cottage, cabin, and chalet prices.

But the other piece is interest rates, which many economists believe will begin to ease around mid-year.

“Recreational property purchases are not as heavily impacted by mortgage rates as those in the residential market,” Soper notes. “That said, consumer confidence in general will get a boost when we see a cut to the Bank of Canada’s key lending rate, expected later this year. This lift in activity will put upward pressure on prices. And, if this coincides with an influx of inventory, we should see a boost in sales as well.”

Storeys (March 20,2024, Zakiya Kassam)