Condo Rent Prices Reach All-Time High

.jpeg)

The average rent for a one-bedroom condo in Toronto has risen by more than 20 per cent in a year as many would-be home buyers remain sidelined by higher borrowing costs.

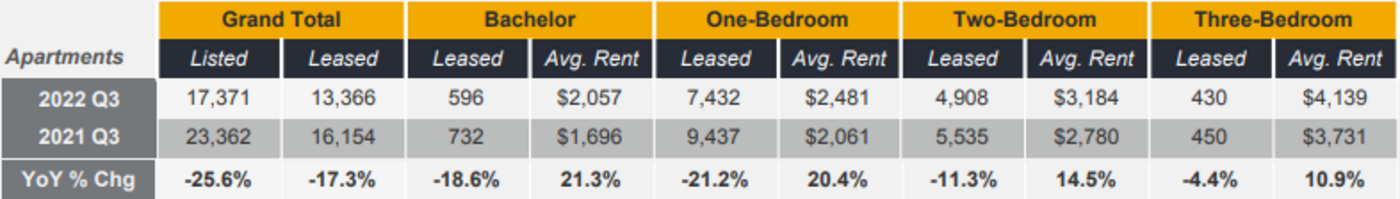

According to the Toronto Regional Real Estate Board’s (TRREB) latest Rental Market Report, the average rent for a one-bedroom condo apartment hit $2,481 in Q3 2022. The figure is not only a 20.4 per cent increase from a year ago, but surpasses the record-high of $2,269 set last quarter.

The average rent for a two bedroom condo in the city was up 14.5 per cent annually in Q3 to $3,184. As with one bedrooms, the price surpasses the previous peak of $2,979 set in Q2 2022.

As rents rose, supply dwindled.

Condo listings were down a staggering 25.6 per cent year-over-year in Q3, while transactions fell by 17.3 per cent - just 13,366 deals were reported through the board’s MLS system.

"Immigration into the GTA plus non-permanent migration for school and temporary employment have all picked up markedly. Add to this the impact of higher borrowing costs on the ownership market and it becomes clear that the demand for rental housing remains strong for the foreseeable future," said TRREB President Kevin Crigger.

"Investor owned condos have been an important component of the rental stock for more than a decade. However, the decline in rental listings over the past year are a further warning sign to policymakers that the overall lack of housing in the region extends to the rental market as well."

TRREB

On Wednesday, the Bank of Canada raised interest rates for the sixth time in 2022, bringing the key rate to 3.75 per cent and further driving up the cost of borrowing. This, the board said, has sustained strong demand and stiff competition in the rental market.

"Rental housing is an increasingly important piece of the housing puzzle," said TRREB’s Chief Market Analyst Jason Mercer.

"While investor-owned condo units have been an important source of supply, current tight market conditions and double-digit average rent growth point to the need for additional purpose-built stock – the construction of which has been lacking in recent years."

BlogTO(October 2022)