Canadian House Prices To Fall 10% In 2024 As Economy Slips Into Recession

Although talks of recession are certainly loaded with doom and gloom, downcast conditions could tempt the BoC to hold rates at 5% until mid-2024.

The Canadian economy is on the cusp of a mild recession, with downturned conditions expected to bleed into 2024. Accordingly, prices are on track to slip an additional 10% by early next year.

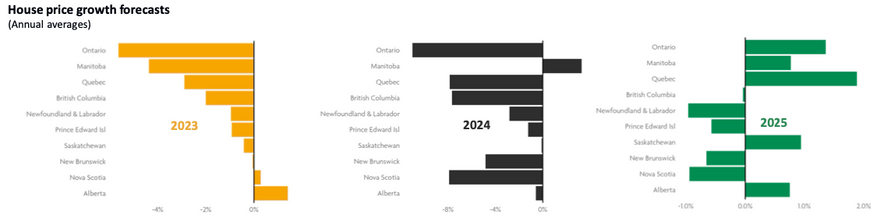

Forecasting released Wednesday by Mortgage Professionals Canada (MPC) and Oxford Economics says that although ‘sharp’ downward price pressure will characterize major Canadian housing markets over the next few years, “the market value of Canada’s housing stock should return to its current level by 2027 Q4.”

Oxford Economics, CREA

Although talks of a recession (even a mild one) are certainly loaded with doom and gloom, it would be a clear sign that the economy has slowed and could mean the end of rate hikes for the foreseeable future.

MPC and Oxford forecast that the bank will opt to hold its benchmark rate at 5% until mid-2024 — which will keep average mortgage rates at 6.1% for the remainder of 2023 — before “gradually easing rates to a neutral level” by early 2027.

Housing Completions, Starts On Track To Lag

With the cost of borrowing at a remarkable high level, housing completions “will remain under pressure” in the year to come, says Wednesday's report.

“Looking ahead, we expect housing completions to fall significantly by 21% next year. The recovery will then be 5.7% gradual with modest growth in 2025 and a much bigger jump in 2026.”

The story is expected to be similarly downcast for housing starts, which are on track to “witness one of the slowest growth rates in a decade across all Canadian regions” for the remainder of 2023.

“Quebec is projected to experience the most significant decline in housing starts, followed by the Atlantic provinces and the Prairies,” says the report.

“Over the rest of the decade, we forecast housing starts to exceed historical levels in the Atlantic Provinces, Prairies, and Ontario, while the other Canadian regions will continue to experience a downturn in growth.”

Storeys.com (Zakiya Kassam, Sept.21,2023)