Buyers' "Strong Bargaining Position" Will Drive Home Prices Down Until Rate Cuts Begin

Dwindling sales over the last several months have shifted market conditions to favour buyers in several major cities, a position they're expected to take advantage of while they can.

It’s been a quiet fall for Canada’s housing markets, as high interest rates, an enduring lack of affordability, and looming economic uncertainty keep prospective purchasers on the sidelines.

For now, at least.

The lack of sales has shifted market conditions to favour buyers in several major cities, including Toronto and Vancouver. Until interest rate cuts begin, many will take advantage of this "stronger bargaining position" to extract further price declines, predicts Robert Hogue, Assistant Chief Economist at RBC, in a new housing market report.

On a national level, home sales have been on the decline for the last four months, including a 5.6% drop from September to October. Resale activity is "at or near depressed levels" in major markets, including Toronto, Hamilton, Ottawa, Montreal, Vancouver, Victoria, and the Fraser Valley, and the MLS Home Price Index has begun to dip in some cities as a result.

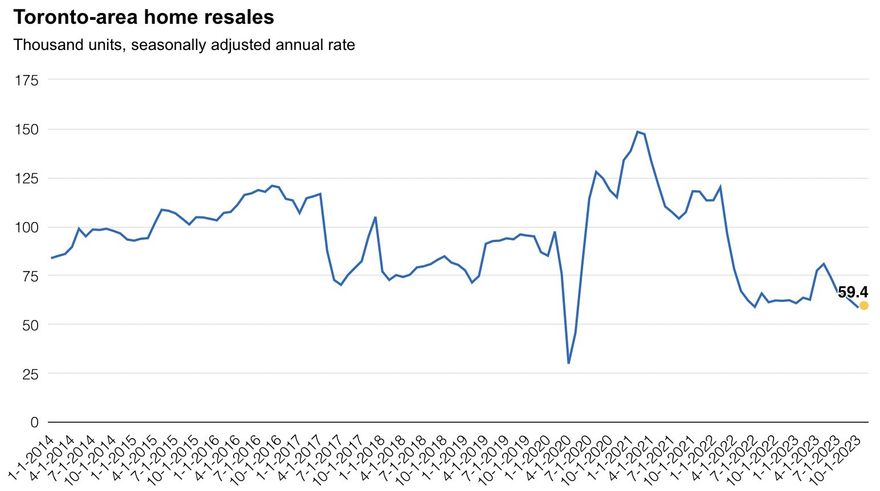

In Toronto, high interest rates are "weighing heavily" on the market. With the exception of the earliest pandemic lockdowns, resale activity is near its lowest level in decades, and new listings have dipped for two straight months. Since August, Toronto’s MLS HPI has dropped 4.8%, or nearly $56,000.

"Odds are prices will continue to fall in the near term. Demand-supply conditions unambiguously favour buyers at this stage," Hogue said.

RBC Economics

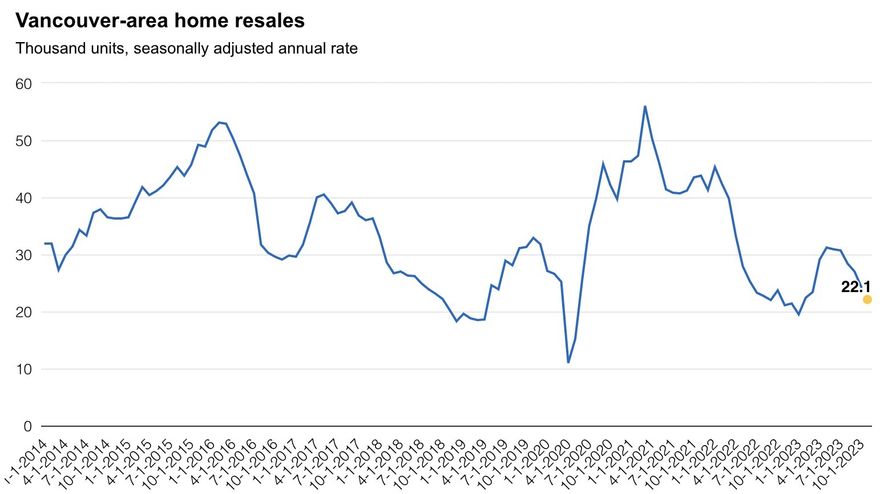

In Vancouver, resales have been on the decline for six months — including an estimated 8% drop in November — and may soon hit a new cyclical low point. At the same time, inventory has begun to inch up, pushing prices down. As in Toronto, Hogue expects further declines are on the horizon.

"We believe it will take sizeable cuts in interest rates to turn the market around," Hogue said. "Extremely poor affordability will remain a major obstacle for potential buyers for some time."

RBC Economics

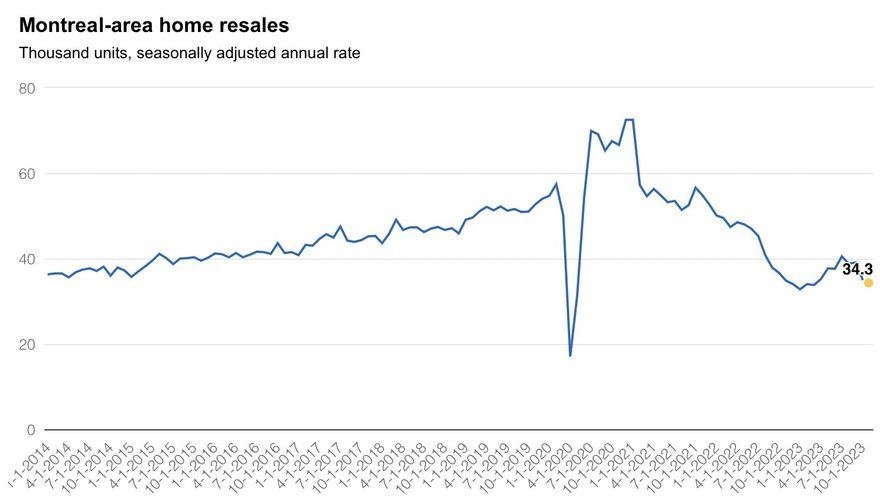

Meanwhile, more balanced, yet equally quiet, conditions can be found in Montreal. Home resales have fallen in three of the past four months and are expected to drop a further 2% in November. New listings have begun to creep up, although they’ve yet to outpace demand.

Even still, median prices for single-family homes and condos have declined for the past two months, a trend that will “undoubtedly” be extended if demand weakens further, as it’s expected to.

RBC Economics

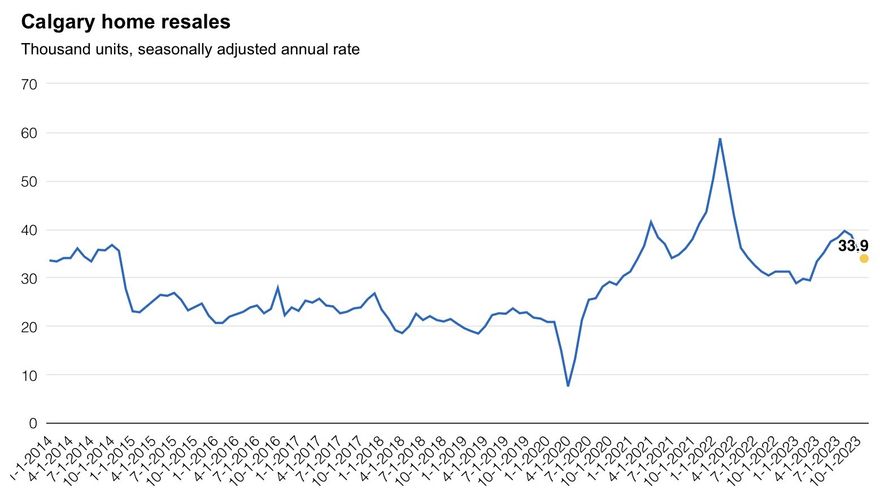

Calgary has been the outlier in 2023, remaining red hot in the face of renewed interest rate hikes and posting price increases as other cities grappled with unaffordability.

However, the market showed signs of moderation last month, the "most surprising" of which was a 38% year-over-year spike in new listings. The 19% monthly increase (seasonally adjusted) in November was the largest since February 2022. At the same time, resales dropped 3.5%, marking the third straight month of decline.

The result is a rebalancing of what had been an "exceptionally tight" market. If supply continues to trend upwards, the rate of price appreciation should moderate. For now, though, prices “continue to escalate at a brisk pace” that far outstrips other markets.

RBC Economics

Despite buyer’s increasingly strong upper hand in many markets, sellers are not suffering. As Hogue notes, there has yet to be a "concerning" rise in supply that would indicate mortgage renewal shock is triggering a wave of forced selling.

However, an estimated 2.2 million mortgage holders are expected to face such shock in 2024 and 2025 as they reach renewal in a significantly higher interest rate environment. If interest rates remain unchanged next year, distress sales may yet emerge.

Storeys (Zoe Demarco, December 11,2023)